The Ring of Shouts: Stock Exchanges in Italy Before Borsa Italiana in Milan

Before the establishment of the Borsa Italiana joint-stock company, headquartered in Milan in 1998, Italy was home to ten different stock exchanges located in Bologna, Florence, Genoa, Milan, Naples, Palermo, Rome, Turin, Trieste, and Venice. Each of these was established in different years during the 19th century, often reviving local civic traditions of institutions devoted to the trading of securities and goods. Regulated first by the commercial codes of the 1800s and later by a comprehensive law passed in 1913, the history of stock exchanges in Italy reflects the evolving financial geography of the country. Among them, the Milan Stock Exchange - operating since 1808 - gradually emerged as the most important, followed by Rome. This trend became even more pronounced in the 1970s, when many banks began to adopt centralized order management systems, channeling most operations through Milan and relegating the other nine exchanges to handling retail clients and small local banks.

The "Open Outcry" System

Frenetic and theatrical, stock trading in Italy relied on the "open outcry" method: the law required that buy and sell offers be shouted aloud by authorized brokers to ensure transparency and public access to trading information. The trading floor, known as the “recinto delle grida” (literally “shouting rings”) or “corbeille” in the French tradition, served as the stage for stockbrokers and their assistants, intent on executing buy and sell orders. The continuous noise and confusion made verbal communication with other rooms and telephone clients difficult and unreliable. Therefore, shouting was supplemented by a codified system of hand signals, used to indicate different kinds of information: numerical signals for quantities and prices, alphabetic signs for company names, and symbolic gestures to represent business activities, product qualities, or general market conditions.

The Milan Stock Exchange

This world came to an end in the 1990s with a series of reforms that replaced the open outcry system with an electronic trading platform, a transition completed between 1992 and 1994. These reforms also ended the brokers’ monopoly over stock exchange contracts, led to the creation of investment firms known as "SIMs" (Società di Intermediazione Mobiliare), and finally transferred management of the exchange from public bodies, such as the Consigli di Borsa, to a private entity: the joint-stock company Borsa Italiana.

Historical Documents at Bocconi Library

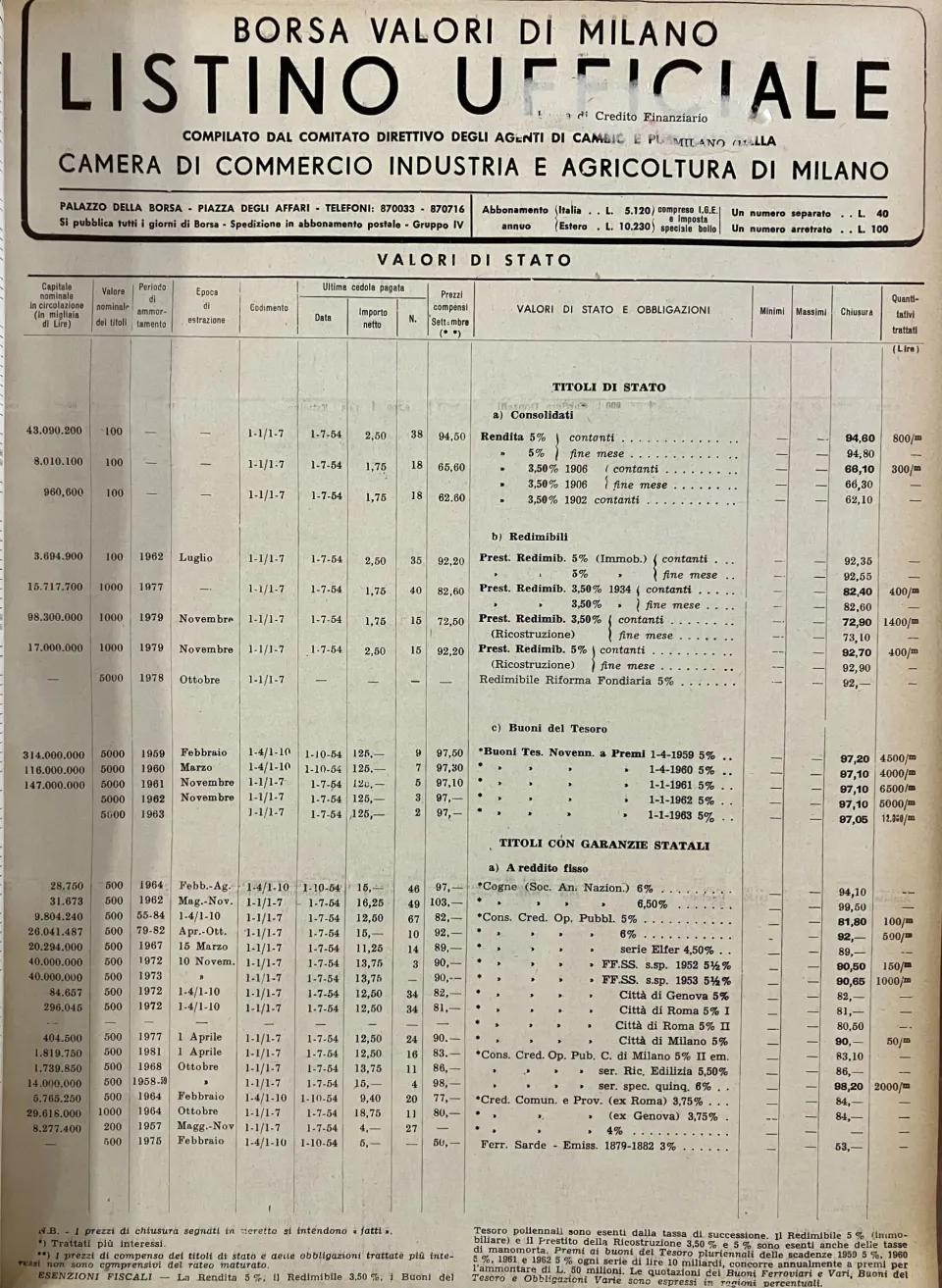

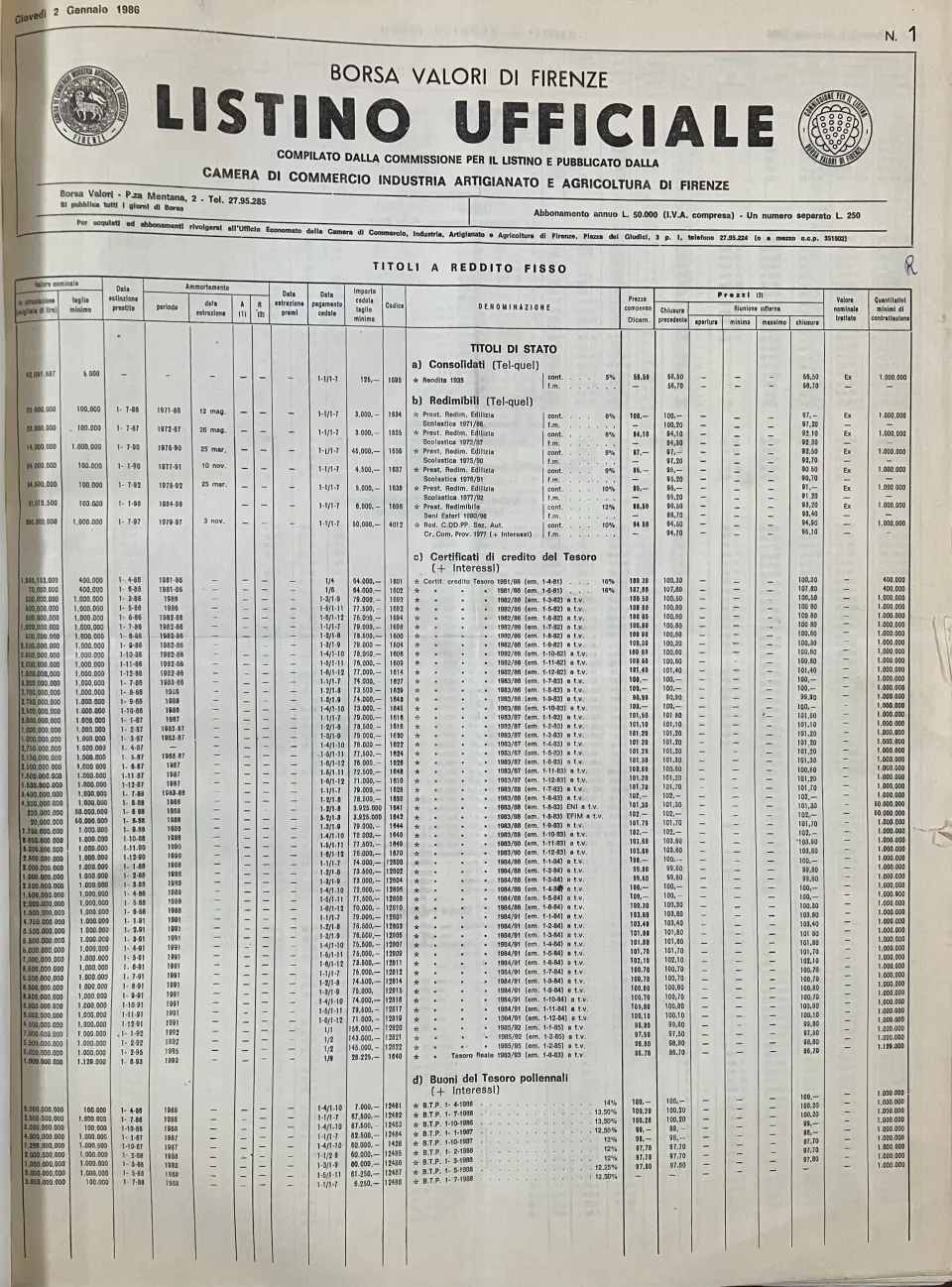

Bocconi Library preserves a significant collection of resources on the activities of historical stock exchanges, beginning with the most complete collection in Italy of price lists from all exchanges, comprising over a thousand volumes. The library also preserves various publications, including L’osservatorio della borsa, La rivista della Borsa and annual reports curated by the Comitato Direttivo degli Agenti di Cambio della Borsa di Milano. Finally, the Library stores the rare Il termometro mercantile e d’industria, which published the quotations of four public debt securities traded on the Milan Stock Exchange in the 1830s.

The Stock Exchange in a humorous cartoon by Giovanni Manca (Source: Biblioteca Comunale Centrale di Milano)

Price List of the Borsa Valori di Milano (Source: Bocconi Library)

Price List of the Borsa Valori di Firenze (Source: Bocconi Library)